Home collateral money is preferred a means to control a beneficial residence’s security, but they possess loans Somerville AL some unique statutes from inside the Texas. When you find yourself interested in household collateral financing and now have issues on how it works, it’s not just you!

As with any type of economic product, you will need to get the ways to your questions and you will discover what you’re getting into before you sign into the dotted range.

Texas House Equity Financing FAQ

To learn more about home collateral funds and just how it works within the Tx, we’ve got accumulated a summary of resources and you may remedies for a number of the best concerns we get in the domestic collateral financing.

5. Can i eradicate my personal house easily standard into a property collateral financing?

When you take aside a home collateral financing, you are credit contrary to the property value your property. This means that for those who standard on the loan, the financial institution has got the directly to foreclose and sell the house to recuperate the loss.

That being said, this is extremely unusual. Should anyone ever feel you might not be able to build a fees to the home financing, communicate this along with your lender. In most cases, loan providers might help having difficulties individuals come across a simple solution this is simply not foreclosures.

Possess other concerns about having fun with domestic security? I fall apart some traditional misunderstandings within the Is actually Family Equity Loans a good idea?

six. Carry out I want to score my house appraised?

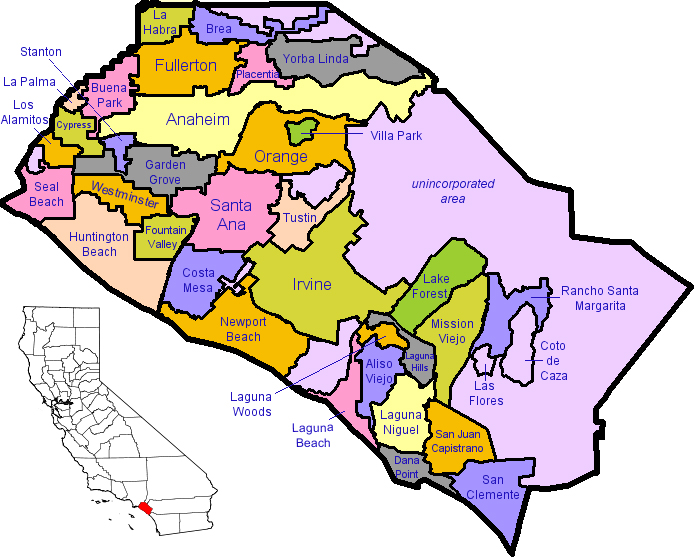

Yes, you will probably want to get your property appraised to decide the amount of security which you have available. The fresh appraisal usually generally be held from the an expert appraiser so you can dictate the current market price of your house predicated on facts like:

- Position of the house

- Attributes of the house

- Venue

- Recent income regarding similar characteristics

- Market fashion

Because the assessment is done, you should have a better idea of exactly how much you could potentially obtain against your home equity.

eight. Why does a house guarantee mortgage vary from a house guarantee line of credit?

Unlike choosing their finance just like the a one-big date financing lump sum, there will be a personal line of credit open, which enables one to acquire out of your lender as required.

View it as a hybrid between a credit card and you will a traditional financing. Once you expose a personal line of credit, you are accepted to have a borrowing limit and you may a selected credit period. When you require money, you go to the financial and you will withdraw extent you would like. You are able to pay just attract about what you really borrow.

8. Was domestic equity mortgage notice tax-allowable?

I added it question because it’s a very popular that-but we are able to merely address they partly. We are really not taxation advantages, therefore can’t give any income tax information.

Oftentimes, household collateral financing interest is actually tax-deductible. I stress from time to time as this is not at all times this new circumstances for everybody. You will need to request a tax top-notch because of it particular matter.

nine. What is the rate of interest to own a house equity mortgage?

Like most funds, house guarantee mortgage rates of interest are different based personal products like credit rating and you will general field standards. The way to uncover what the interest rate would feel like is to look around and compare lenders.

ten. Manage domestic guarantee funds has settlement costs?

Texas rules limit financial fees to help you dos% away from a great loan’s dominating. Amplify Borrowing Relationship has actually family guarantee loan settlement costs reasonable with an apartment $325 closing fee- regardless of amount borrowed.

Have more Questions?

Develop it short FAQ solutions any concerns, but if you have more, please reach out to the loan positives at the Amplify Credit Partnership. The audience is always prepared to help you get already been towards the software techniques otherwise give you details about your loan options.