Should you get a credit card which provides spectacular rewards otherwise part redemption assistance, keep an eye out this type of notes commonly feature higher APRs. Whether your cards has you cash back to the the purchases, travelling perks and other great incentives, you’ll likely find yourself with a high Apr to help you take into account those individuals will cost you.

Area

Place features an impact on the Apr also, particularly if you are receiving a mortgage loan. https://paydayloanalabama.com/kinston/ Additional says and you can local governing bodies may have different laws which will perception charge or other individuals will cost you might stop right up spending, therefore altering your Annual percentage rate too.

The truth inside the Credit Operate (TILA) means loan providers to disclose the new Annual percentage rate from financing otherwise borrowing from the bank cards up until the borrower is also indication almost any price. While shopping around to possess handmade cards, just be capable of seeing upfront in the render what the fresh Annual percentage rate each and every credit is really so you could potentially contrast will cost you regarding some other loan providers.

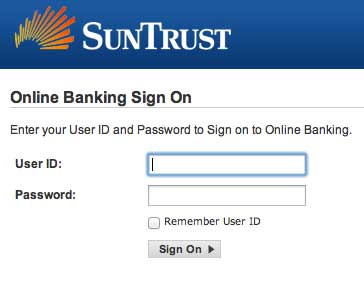

For folks who actually have a charge card and you are unsure what your Apr was, you will find several methods for you to find out. It must be noted on their monthly report, but you can plus see it because of the signing in the account on the internet and watching the information of line of credit.

What makes Their Apr High?

For those who looked this new Annual percentage rate on your own charge card otherwise mortgage regarding fascination and you may was basically surprised at exactly how high it was, you are not by yourself. Of numerous consumers was confused as to the reasons its Apr is high than simply it believe it must be. Let’s review several causes the rate might be high.

Financing Variety of

For those who have financing, it may come with a high ple, signature loans for example some signature loans will often have higher APRs since they’re not backed by any kind of collateral. Secured personal loans, as well, usually come with lower APRs since the mortgage was supported by a piece of your property, like a house otherwise car, that is certainly grabbed and offered should you decide are not able to build repayments.

Handmade cards will feature higher elizabeth reason since unsecured loans: nothing is in position to show you will create your costs timely. You can find things like secured handmade cards, however, that allow you to prepay your personal line of credit matter for your financial to hold while the security. Since your bank possess a means to recover its losses, should you decide prevent making costs, such notes are apt to have all the way down APRs.

Having said that, charge card purchase Apr would not actually number for folks who pay your own equilibrium away from entirely per month as you may not be charged on the a running harmony.

Low Credit score

If you have imperfect borrowing from the bank, your credit rating could well be contributing to a premier Apr. Your credit rating shows lenders exactly how you addressed your debts within the for the past, and if debt background might have been a tiny rugged, loan providers might only be considered your to possess handmade cards and money with highest Apr making upwards on financing exposure.

Debt Weight

Lenders including check your debt-to-earnings ratio, otherwise DTI, to determine your Annual percentage rate. Their DTI tips how much cash personal debt you really have in comparison with how much money you take domestic after the newest big date. When you yourself have excess loans, lenders tends to be quicker prepared to let you borrow funds because you happen to be expected to fail to make costs. Extremely loan providers like that your DTI are beneath the 40% range, but it is crucial that you remember that the lower your own DTI, the reduced Apr you will be offered.